Over 80% of startups and SMEs across the country expect a scaling down of their operations, a complete shut-down, or selling off their businesses over the next six months.

Globally, India has the third-largest ecosystem for successful start-ups, behind China and the US. In 2019, Indian start-ups had raised over $11 billion. This was 55% higher than in 2018 in value and 30% higher in deal volume. According to the US-India Strategic and Partnership Forum, in the next five years, they could attract investment of over $21 billion, creating 550,000 direct and 1,400,000 indirect jobs. In February, some had planned to go for the public issue over the succeeding months. Then came the Covid-19 pandemic, bringing with it global lockdowns, closed borders and stuck funds.

The Indian startup ecosystem – hitherto heralded for its rapid growth – is facing its biggest challenge yet, with its very survival at stake due to the COVID-19 crisis, according to a Nasscom survey,

According to a recent NASSCOM study, out of 9,300 tech start-ups, most suffered a severe impact, with the bigger impact being felt by early- to mid-stage start-ups. It was reported that “90% plus was facing a decline in revenues, 30-40% temporarily drew shutters on their operations or in the process of closing down and 70% had a runway of fewer than 3 months”. This has a serious bearing on the emerging start-up ecosystem in India—both because of the highly intertwined nature of the businesses, and also because of the job losses.

COVID-19 Impact On The Start-Up Ecosystem

By Rajan Anandan, MD, Sequoia Capital India

Worst hit Start-ups

Early-stage and mid-stage startups are the most impacted, particularly those in the business-to-consumer (B2C) space, revealed the Nasscom survey, which received responses from more than 250 startups across all stages. Within the B2C space, a third of these startups have a runway of fewer than three months, it said.

In fact, according to the survey, around 60% of B2C startups face closure as revenues plummeted to near-zero levels after businesses were forced to remain shut during the nationwide lockdown aimed at curbing the spread of the virus.

“With the need to conserve cash in hand, business growth trajectory has come to a standstill. (The) need for rapid technology up-gradation has added to the burden,” wrote Nasscom research analysts in their report titled ‘Reviving the Indian Startup Engine During COVID-19’.

Many startups have been forced to undertake severe cost-cutting measures, such as laying off staff, slashing salaries, and ceasing all expansion plans and projects, in a bid to preserve cash and have a longer runway in an uncertain operating environment.

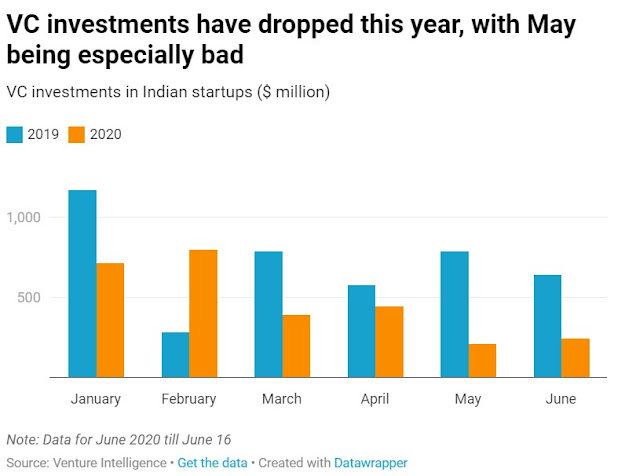

Impact on Startup funding

But it’s not just revenues that are taking a hit. The impact on startup funding is also being felt across sectors.

“Funding shortage is being felt by most startups and can affect long-term sustainability,” Nasscom analysts wrote in their report.

At least 65 % of startups are facing “significant negative impact” on funding due to the COVID-19 crisis, with most early-stage startups facing a major funding crunch.

Earlier this year, many prominent venture capital firms such as Sequoia Capital, Accel, and LightSpeed sounded a cautious note to Indian startups, warning that a tough and uncertain macro environment would make for a difficult funding environment.

Among sectors, agri-tech and fintech startups are the worst hit when it comes to funding, while health-tech is emerging as the only sector witnessing a more favourable funding environment, the Nasscom survey found.

To combat the funding crunch, startups are resorting to several measures such as seeking government support, loans from banks and non-banking financial institutions, and capital infusions from existing and new investors, the survey showed.

Impact on Start-ups Revenue

As demand came to a standstill during the lockdown, startup revenues have been hit hard, forcing many businesses to either shut down or transform their business models altogether to withstand the crisis.

According to the Nasscom survey, over 90% of startups face revenue declines. The decline in revenues is expected to be as steep as over 80% for at least 34% of startups. For the remaining startups (over 60%), the decline in revenues is expected to be more than 40%. Travel and transportation startups expect revenues to decline by more than 40%, as changes in consumption and perception of these industries will mean that business activity in these industries will not return to pre-pandemic levels. The lone bright spots are the edu-tech sector, where 14% of startups are seeing a growth in revenue, and the business-to-business (B2B) space, where revenue declines are expected to be less severe.

Government support needed

Two-thirds of all startups surveyed believe that the COVID-19 impact will last up to a year, with a majority seeking immediate government support in the form of favourable policies, easing regulations, partnership opportunities, and reimbursements on immediate fixed costs, among others.

“To ensure that the Indian startup movement and its growth trajectory is not derailed, coordinated support from key stakeholders is the need of the hour. Some of our key recommendations to the government include access to working capital, easing compliances and fiscal policy, and funding support,” Debjani, NASSCOM President says.

Nasscom is also recommending that the Startup India Fund accelerate disbursement of funds, with more funding support being provided to early-stage startups.

“Ups and downs in life are very important to keep us going, because a straight line even in an ECG means we are not alive”, Ratan Tata

@N.Ramchander

Comments

Post a Comment